Table of Content

- VA funding fee rate charts

- Best Tips When Buying Your Home With a VA Mortgage

- VA Home Loan Payment Calculator

- What kind of VA-backed loan will I need to buy a home?

- Getting the VA Certificate of Eligibility (COE)

- Changes to VA Loan Limits in 2020

- Disability and Prior VA Loan Use

- Are Taxes Part of My Monthly Mortgage Payment?

The VA Loan Program is designed for veterans and members who are currently serving in the military. Those who qualify are eligible to receive home financing with no down-payment and little to no closing costs. There are a few conditions and requirements one must meet in order to qualify. Another way to reduce your monthly payments is by cutting off the interest rate. You can decrease the interest rate by comparing quotes provided by different lenders, improving your credit score, and applying for additional benefits.

You should be in close contact with your real estate agent and VA loan lender when putting together a sales agreement. They will provide you the necessary instructions for signing and submitting to the seller. They come with a funding fee, which is paid to support the program. Adjustable-rate mortgages are home loans with varying interest rates. Initially, the interest rate remains constant; however, after the initial term, the loan resets, and so does the loan interest. Veterans with full entitlement will be able to borrow as much as they need without making a downpayment.

VA funding fee rate charts

If the appraised value is less than the selling cost of the house, there are a few things you can do. Pre approval gives you a glimpse at how much you can afford. This will help you set expectations upfront and encourage you to look for a house within your budget. Getting pre approved is the first step in getting a VA loan. The house must be a single dwelling that is legally considered to be real estate and is readily marketable.

It includes loan terms, fees, closing costs, and your estimated monthly mortgage payments. Your lender may also ask you to provide more information or documents at this time. This one-time fee helps to lower the cost of the loan for U.S. taxpayers since the VA home loan program doesn’t require down payments or monthly mortgage insurance.

Best Tips When Buying Your Home With a VA Mortgage

You are a surviving spouse who has not remarried after the death of a veteran while in service or from a service-connected disability. Or, you remarried when you were 57 or after Dec. 16, 2003. Those whose spouses are missing in action or prisoners of war may also apply. Current income and debts can drastically impact the amount service members can borrow. A yardstick known as the debt-to-income ratio helps lenders decide how much additional debt a veteran can handle.

You can borrow as much amount you qualify for, given you make up the difference with a downpayment. Depending on the benefits available to other service types, a veteran’s loan may differ from a reservist’s loan. I have a low credit score and my wife owns land in Louisiana.

VA Home Loan Payment Calculator

Lenders offer competitive interest rates on VA-backed purchase loans. This can help you buy, build, or improve a home—especially if you don’t want to make a down payment. Find out if you’re eligible for this loan—and how to apply for your Certificate of Eligibility. There are certain types of income that do not meet VA lending guidelines. Income that cannot be used to qualify for a VA loan include gambling or lottery winnings. One- time performance bonuses may not be used nor any isolated payment to the borrower by an employer.

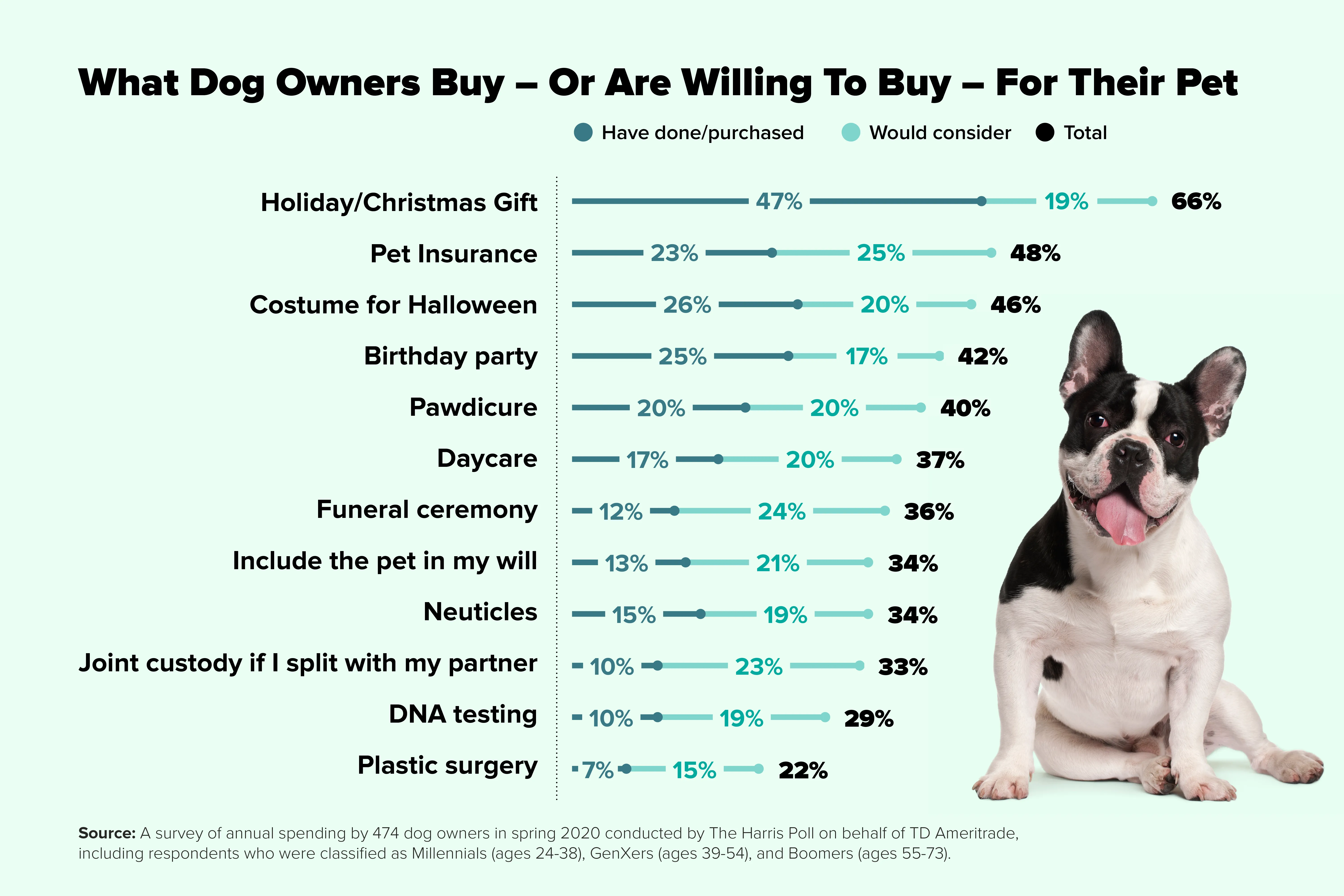

Down payment and VA funding fee amounts are expressed as a percentage of total loan amount. You may be eligible for a refund of the VA funding fee if you’re later awarded VA compensation for a service-connected disability. The effective date of your VA compensation must be retroactive to before the date of your loan closing.

Your debt-to-income ratio will help you understand more about your total monthly debt and home affordability, which we’ll cover in more detail later. Talking to a VA lender about your home loan affordability is always a smart first step during the homebuying process. At today’s interest rate of 5.98%, a borrower with a 15-year, fixed-rate jumbo refinance would pay $6,321 per month in principal and interest on a $750,000 loan.

Your lender typically requires two years of W2s and current pay stubs to verify income. Benchmarks can vary by lender and the borrower’s specific circumstances. Buyers whose DTI ratio exceeds 41 percent will encounter additional financial scrutiny, but that’s by no means a strict cutoff. The 2023 BAH rates are designed to meet current housing costs. And one last note, just because you debt ratios allow you to borrow $309,000 that doesn't mean you're required to.

Choosing a short loan term increases your monthly payments significantly. However, it also reduces the interest rate, which helps you save thousands over time. Candidates who make a downpayment of less than 5% are expected to pay 2.3% of the total loan amount if they are borrowing a VA loan for the first time.

VA loan appraisal is an assessment conducted by the US Department of Veterans Affairs to evaluate the property’s value. There was a foreclosure on a previous VA loan you failed to repay. You borrowed a VA loan and had a foreclosure but repaid the amount in full.

For all other types of VA loans, the funding fee rate doesn't change based on your down payment amount or your past loan usage. For VA-backed purchase and construction loans, your funding fee rate will be based on your down payment amount and loan usage. If you used a VA-backed loan to purchase a manufactured home in the past, you'll still pay the first-time funding fee rate.

No comments:

Post a Comment